Financing in Mexico

This blog dives deep into financing — everything you need to know.

Wondering how to pay for your piece of paradise in Puerto Peñasco?

If you're considering financing instead of paying all cash, this guide is for you.

From seller finance to Mexican bank loans and developer terms — you'll find loan options, lender contacts, and real numbers to help you plan confidently.

It´s 3 options: Seller financing, Developer Financing and a traditional loan:

1. 💵 Cash Purchase

Simple, quick, and often the easiest route — if you’ve got the funds, many properties in Rocky Point are ready to go!

But where do people get the cash? There are lots of creative ways buyers make it happen. Some refinance a home, others tap into retirement accounts like a Self-Directed IRA or pull from insurance policies. And believe it or not, many people own property they’ve forgotten about or inherited — especially in Mexico. These unused assets get sold, and the proceeds are redirected to invest in Puerto Peñasco real estate.

Another great strategy? Team up with friends or family! Pooling resources can boost your buying power and open the door to owning a vacation property sooner than you thought. Families do it all the time — it’s a smart, shared investment in fun and future value.

And remember, cash isn’t the only option… up next: financing possibilities!

2. 🧾 Seller Financing

Many sellers offer flexible terms that make it easy to own property without going through a traditional bank.

Typical terms:

✔️ Often no credit check

✔️ Most commonly 50% down payment (varies by seller)

✔️ 3–5 year term (depends on the seller)

Monthly payments for the balance are usually structured to pay off the loan fully over the term. However, sometimes a balloon payment is agreed to.

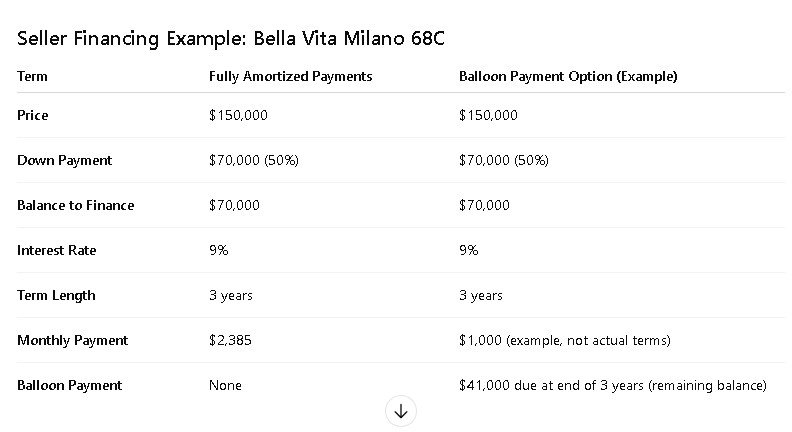

Seller Financing Example: Bella Vita Milano 68C

What is a Balloon Payment?

A balloon payment is a larger lump sum due at the end of the loan term after making smaller monthly payments throughout. It can help lower your monthly payments but means you’ll owe a significant amount all at once at the end.

Important Notes:

Bella Vita Milano’s seller prefers full amortization (no balloon) — monthly payments of about $2,385.

Balloon payments are negotiable, but keep in mind that you’ll need a plan to pay the balloon amount when it comes due.

Seller financing terms vary and are often flexible — it never hurts to ask!

💡 Pro Tip: Everything is negotiable — sometimes sellers are open to adjusting price, down payment, or terms depending on your offer.

3. 🏗️ Developer Financing (Pre-Construction)

Many developers offer in-house financing, which is great for international buyers wanting less red tape.

✔️ No residency needed – just a valid passport

✔️ Often no credit check

✔️ Down payment: 20%–60%

✔️ Terms: 7–15 years

✔️ Rates: As low as 6% (the more down, the better the rate)

🔑 Examples:

Caracoles Resort

2 bed / 2 bath – a few blocks from the beach

From $159K USD

$90K down

$69K over 9 years at 11%

Approx. $1,010/month

Encantame Towers (Beachfront)

From $430K USD

40% down

Up to 20-year term

Rates: 6%–9.9%

4. 🏦 Mexican Bank Loans

Looking for longer terms and lower monthly payments? Mexican banks can offer loans — even if you live and work in the U.S. Some banks will qualify you using U.S. credit and proof of income.

Typical Terms:

✔️ 10%–20% down

✔️ 10–20 year terms

✔️ Rates between 8%–12%

✔️ Monthly payments depend on amount + term

✅ Required documents (may vary slightly):

Valid ID (passport or residency card)

Proof of income

Credit history (U.S. or Mexico)

Bank statements

💡 Tip: Use your preferred down payment to estimate which options might work best for you.

Loan officer Contacts:

Lupita Flores Works with multiple Mexican Banks

Works with Mexican buyers & U.S. buyers with Mexican residency or Voting card

📞 +52 662 349 4511Maria Barajas Works with multiple Mexican Banks

Works with Mexican & American buyers — no residency needed

📞 +52 1 662 349 4511Diana Salazar Works BANORTE

Works with Mexican & American buyers —

📞 +52 1 638 105 3142 (send whatsapp 1st) Diana.salazar.torres@banorte.com

Are You Mexican or Have Mexican Roots?

You may qualify to purchase property as a Mexican national — which can save you thousands in trust fees and simplify the process.

Make sure your INE (voter ID) is current.

If you're in the U.S., visit your local Mexican Consulate to apply or renew.

Born in the U.S. but have a Mexican parent? You may qualify for dual citizenship.

📌 To buy as a Mexican citizen, you’ll also need an RFC (tax ID), issued by SAT ( The Mexican IRS) in Mexico. (Your INE is required first.)

Need help? Reach out to:

Carlos Gutiérrez

📞 +52 1 638 116 7302

👉 Want step-by-step guidance?

Read the full guide on buying as a Mexican citizen →